Analysis: UK government’s climate U-turns put legally binding targets in jeopardy

Simon Evans

09.20.23Simon Evans

20.09.2023 | 4:58pmA series of U-turns in climate policy announced by prime minister Rishi Sunak could put the UK’s legally binding emissions targets in jeopardy, Carbon Brief analysis shows.

The rollbacks include delays to bans on the sale of new fossil-fueled cars and boilers, both key planks of the government’s strategy for reaching its climate targets.

These rollbacks would create an increasingly large gap between where the UK’s emissions are heading and where they are supposed to go, Carbon Brief analysis shows.

As such, the UK’s legally binding emissions targets, as well as its international pledge under the Paris Agreement, could be put out of reach.

Net-zero strategy

In March 2023, the government updated its net-zero strategy, after the High Court ruled the previous 2021 version was unlawful.

The update had already weakened the UK’s ambition, according to the government’s own figures, and fell short of putting the country firmly on track for its legal targets.

Now, Sunak has put a series of key policies at risk, including the zero-emissions vehicle (ZEV) mandate supposed to drive the transition to electric vehicles (EVs) and the end dates for sales of fossil-fuel boilers, as well as standards for home energy efficiency.

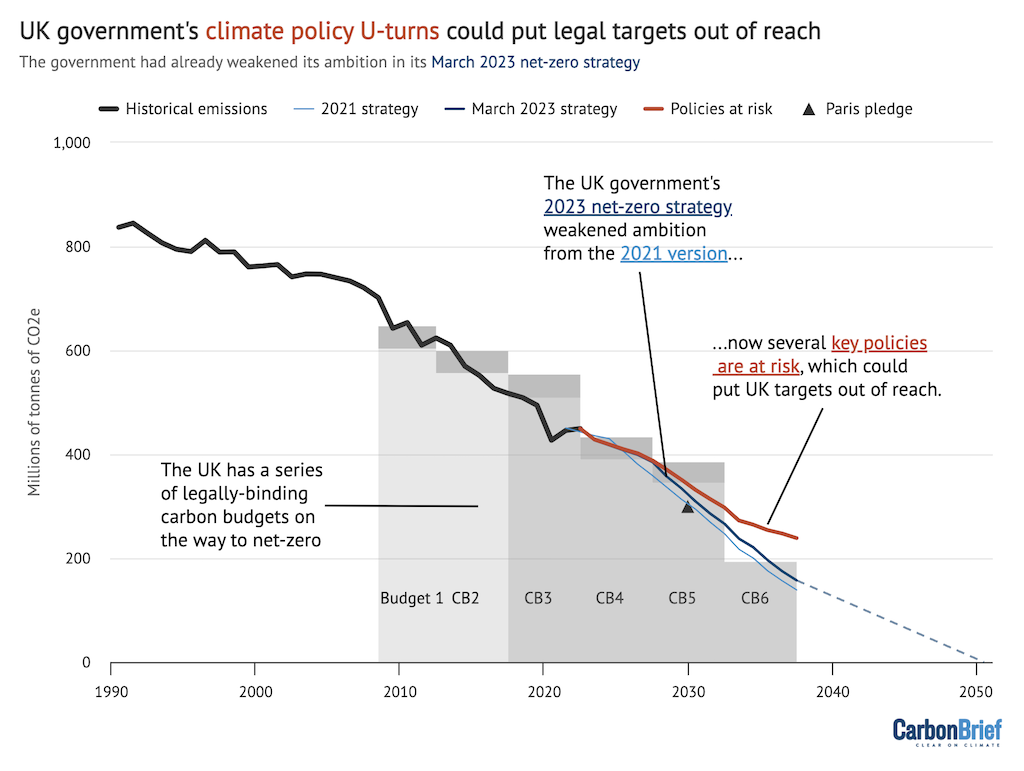

The chart below shows how UK emissions have already changed since 1990 (black line).

The country’s legally binding climate goals under five-yearly carbon budgets are shown with grey shading. These are interim goals on the way to the target of net-zero emissions by 2050.

Progress in cutting emissions under the 2021 net-zero strategy, according to the government’s own numbers, are shown with the light blue line, with the March 2023 update shown in dark blue.

The red line shows the aggregated emissions savings from policies which are now at risk as a result of Sunak’s climate policy rollbacks, based on the government’s March 2023 estimates.

The largest emissions savings at risk from Sunak’s rollbacks is the ZEV mandate, which implements the government’s pledge to ban the sale of new petrol and diesel cars from 2030.

According to the government’s March estimates, the ZEV mandate was expected to have saved some 23m tonnes of carbon dioxide equivalent (MtCO2e) per year on average during the sixth carbon budget period (CB6), covering 2033-2038.

With Sunak weakening the 2030 ban, these savings are now at risk. A more precise accounting will not be possible until the government publishes full details of its plans.

Targets out of reach?

The scale of emissions savings put at risk by Sunak’s rollbacks could put not only the UK’s legally binding sixth carbon budget (CB6 in the chart above) out of reach, but also its international pledge under the Paris Agreement (black triangle).

Although the UK’s Paris pledge – to cut emissions to 68% below 1990 levels by 2030 – is not legally binding, it would be politically embarrassing for the country to fall short, as the recent host of the COP26 climate summit and a supposed leader on international action.

Without significant new policy measures to fill the gaps created by Sunak’s rollbacks – which do not appear likely to be forthcoming – his government has two further options.

First, the UK could make use of “flexibilities” within the Climate Change Act 2008. These allow the government to “carry forward” overachievement from earlier carbon budget periods, in order to meet subsequent limits, on paper.

The UK fell well within the third carbon budget, for example, thanks in large part to the emissions impact of the Covid pandemic.

The Climate Change Committee (CCC) has repeatedly argued that the government should only carry forward genuine emissions savings, driven by successful climate policy, rather than banking cuts due to external factors, such as Covid lockdowns or the 2008 global financial crisis.

A second, more extreme option for the government would be to revise the levels of the legally binding carbon budgets themselves. However, to do so it would have to follow a set procedure under the 2008 act.

This procedure would require the government to seek published advice from the CCC on its proposal to amend the carbon budgets, as well as consulting the devolved administrations in Scotland, Wales and Northern Ireland.

Crucially, the government would also need to secure majorities in both houses of parliament.

Adam Bell, director of policy at consultancy Stonehaven and a former senior energy official, tells Carbon Brief there is “basically zero” chance of this happening. He says:

“I would place the odds of actually getting a majority to do so before the next election at basically zero. The Lords will delay it.”

-

Analysis: UK government’s climate U-turns put legally binding targets in jeopardy